To provide context to these comments and to educate new members, here is our four-part approach to tax reform:

- Value Added Tax (VAT) to fund domestic military spending and domestic discretionary spending with a rate between 10% and 13%, which makes sure very American pays something. A Carbon VAT is included.

- Personal income surtaxes on joint and widowed filers with net annual incomes of $100,000 and single filers earning $50,000 per year to fund net interest payments, debt retirement and overseas and strategic military spending and other international spending, with graduated rates between 5% and 25%. Capital Gains Taxes will be replaced by an Asset VAT or A-VAT in long-held assets and a Tobin Tax for short term trades would fund the SEC and pay down the debt.

- Employee contributions to Old Age and Survivors Insurance (OASI) with a lower income cap, which allows for lower payment levels to wealthier retirees without making bend points more progressive.

- A VAT-like Net Business Receipts Tax (NBRT), which is essentially a subtraction VAT with additional tax expenditures for family support, health care and the private delivery of governmental services, to fund entitlement spending and replace income tax filing for most people (including people who file without paying), the corporate income tax, business tax filing through individual income taxes and the employer contribution to OASI, all payroll taxes for hospital insurance, disability insurance, unemployment insurance and survivors under age 60. Collection is accomplished by states, who forward data to the IRS.

During the last Congress, budget and appropriation processes were examined without result. DoD financial planning and operations depend on prompt enactment of funding legislation. The solution must include incentives to keep the process moving.

Automatic appropriations would occur at Joint Budget Resolution marks, and if no resolution is passed, revised Budget Control Act spending caps would end this difficulty and spur action by both parties. Because BCA levels are too low, the marks in the Act could be increased by the legislation amending the process itself. These marks should be realistic rather than punitive. Part of any reform must include new caps be set through 2025, when parts of the TCJA expire as well.

Our tax reform plan includes rationalizing domestic civil and military discretionary spending and VAT funding both. For more budgetary responsibility, a Constitutional Amendment is required to enact a regionally specific VAT because under the current constitutional authority all excuses, including VAT, must be nationally uniform. Regions could then decide on whether they can afford more or less spending or higher or lower taxes to support it, nut with a requirement for fund balance. These decisions would require another round of base closings and realignments.

Our current proposal is to reorganize the current ten administrative regions to seven regions of approximately 71 electoral votes and greater autonomy. Each will have a regional vice president and House and Senate caucus who, among other things, set fiscal policy. Creation of regional Vice Presidents and caucuses can occur through legislation, although they could also be constitutionalized.

A constitutional amendment would be required, however, to allow the Electoral College in each region to select the regional Vice President when that individual is not of the same party of the President.

Spending that is national in scope, such as overseas military deployments, naval sea operations and strategic nuclear spending, would be funded by the Income Surtax and Asset VAT, while domestic national spending, such as the National Institutes of Health and NASA would be funded by a national VAT.

In our proposal, the military services would also reorganize along regional lines, with an Air Wing and Army for each region. Naval base operations would be regionally funded and led as well. Deployed forces would continue to be operated under current command structures. Nuclear weapons systems procurement would remain national and would be commanded on a national basis.

No regional Vice President will control nuclear weapons. National command authorities will be nationally funded. The National Nuclear Security Administration in the Department of Energy will also be nationally funded. Product commands would have regional and national funding based on unit deployment within CONUS and overseas. Operations and Maintenance funding would be regional, with deployed operations funded nationally under bullet two of our proposal.

Costs for the Veterans Administration and for military retirement will be funded through the VAT, the NBRT and the income surtax. Non-entitlement costs will be VAT funded. Entitlements for retirees and veterans, including normal retirement pay, will be funded through the S-VAT, especially if a personal retirement account system holding shares in the new employer replaces current pension, while disability retirement and health care for service in combat will be funded nationally through the income surtax in bullet two above.

We expect that during this time of war, the income surtax as currently estimated will not be adequate to fund all overseas deployments, which will necessitate continued deficit financing. Indeed, the entire Central Command war effort has depended on Overseas Contingency Operations (aka supplemental appropriations) funding to get past the spending caps in the Budget Act and the Budget Control Act of 2011. Making all deployments that require deficit financing explicit will serve as a good argument for increased tax rates – especially overseas as the income surtax will also fund the payment of net interest and the eventual repayment of war debt.

The national debt is possible because of progressive income taxation. There is no per capita debt because there are no per capita taxes. The liability for repayment, therefore, is a function of that tax. For every dollar you pay in taxes, you owe $13 in debt. People who pay nothing owe nothing. People who pay tens of thousands of dollars a year owe hundreds of thousands. The answer is not making the poor pay more or giving them less benefits, either only slows the economy. If higher income taxpayers wish to finance deployments and roll over net interest payments and debt reduction, starting with the reimbursement of the Social Security Trust Fund as the Baby Boom spends it down, then the high income taxpayers if the future, their children and grand children, will be required to (again, with interest).

While bringing funding closer to home with regional funding will undoubtedly restrict what can only be regarded as out of control cost growth in Department of Defense, the cutting of too many jobs in the defense sector during what is arguable an economic Depression is not wise either. Tax increases are the preferred way to get to balance.In the long run, as we deescalate from war and must decrease defense research and procurement, we recommend that the appropriation for the National Aeronautics and Space Administration be moved to the defense appropriations subcommittee and that funding for manned space flight and space exploration be increased at the expense of defense research and procurement.

A significant increase in civilian space exploration is likely just what the economy will need and will impact both the aerospace and nuclear industries, as off-world colonies will undoubtedly require nuclear power if they are to be constructed on any reasonable scale, particularly lunar colonies which will face 15 day dark periods. Initially, these activities will be funded by a nationally based VAT, however as private space infrastructure grows, funding can be transitioned from direct support to loan guarantees for private space operations as citizen access to space increases. Given the risks, however, some degree of direct funding is currently essential to quickly ramp up space infrastructure and thus lower the cost.

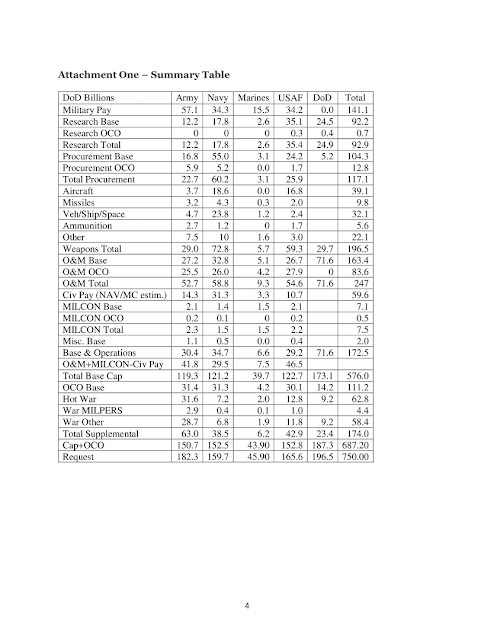

The National Priorities publishes a pie chart of discretionary spending which lumped the entire defense budget into a 57% slice. Attachment One presents a summary table on which we base our analysis. Attachment Two offers a more detailed perspective on how departmental spending subtotals relate to size of civilian departments, including when grouped for comparable analysis to DoD as a whole. Attachment Three illustrates how a regional breakdown of the defense budget might look. State level data is not provided in current budget documents, with the exception of military construction projects (MILCON).

Attachment One – Summary Table

Attachment Two – Shares of Discretionary Budget

Attachment 3 – Regional Distribution

Note that it was impossible to separate out Strategic Nuclear facilities for this simulation. We will use these subtotals to estimate the distribution of domestic Operations and Maintenance (O&M), Military Personnel (MILPERS) and Procurement. The O&M spreadsheet provided by OSD can also be used to estimate the proportions of CONUS (VAT funded) and Strategic and OCONUS forces (Income Surtax & Asset VAT funded). RDT&E will be funded nationally in this illustration. We are confident that the Department of Defense and the Department of Veterans Affairs could present regional breakdowns should our recommendations be enacted. to calculate such figures.

0 Comments:

Post a Comment

<< Home