House Budget: President's Budget FY 2022, June 9, 2011

Finance: President’s FY 2022 Budget, June 16, 2021

WM: President's FY 2022 Budget, June 17, 2021

Ensure big corporations pay their fair share. Corporate income taxes would be discontinued and replaced by an employer-paid subtraction value added tax on all businesses, thus taxing both labor and capital at the same rate for the first tier, with a proposed rate between 13% and 20%. No net revenue would be collected. Rather, this tax would fund an expanded refundable child tax credit at more generous than the President’s proposal, as well as health care costs for employees and their families. Some employers will overpay, while others will get a refund. Higher tier salary taxation will be collected with this tax.

A matching state tax would supplement the child tax credit in higher cost states, while providing funds for education through the junior college and vocational levels. States would collect both state and federal taxes. These items will be discussed below.

End tax loopholes for the wealthy. Provide the IRS with the resources it needs to crack down on wealthy tax cheats and improve taxpayer services. In general, we propose ending personal income taxation for all but the wealthiest taxpayers. The threshold for salary taxation will be $85,000, however it will be collected by employers with tax rates ranging from 12.5 % to 25% at and above $340,000 per year. Personal salary taxation will begin at $425,000 at 12.5%, increasing to 25% at $680,000, for an overall rate of 50% from both revenue streams. The salary surtax could be remitted in advance by purchasing tax prepayment bonds. This would reduce future net interest costs, which are the main driver of future budget imbalance.

The largest loophole for the wealthy is not mentioned in the President's Budget. If there is a third rail in income taxation that mirrors the third rail in Social Security, this is it. The largest boon to the wealthy is the exclusion of mutual funds from payment of capital gains and income taxation. This ensures the accumulation of wealth by the rich at the expense of everyone else. By our calculations, 28% of mutual fund (and bond) assets are held by the top 1,450 families. Over half of these assets are held by the top 0.01%. The bottom 90% hold only 23% of such assets, and many of these are likely held by well-off retirees.

Shifting taxation to an asset value added tax from personal income taxation at 25% (which is the rate currently being discussed in budget negotiations) would tax capital gains, dividends at distribution, and interest at distribution. Rental and real property assets will be taxed at the state level. The federal tax would be remitted to the Securities and Exchange Commission, while states would collect rental income monthly and capital gains taxes at closing.

Asset VAT would be marked to market (not gain) at option exercise and at the first sale after inheritance, gift and donation. The estate tax would be repealed. Family businesses and assets would not have to be sold to pay estate taxes, but once the family business is sold, any advantage will be ended. There will be no loopholes, save one, and no need for extra audit resources. The only loophole would be zero rating sales to qualified Employee Stock Ownership Plans.

Cash inheritances would not be taxed, but because a goods and services taxes will be established (increased minimum wages and child tax credits will hold the working class harmless), heirs will no longer evade taxation forever. Most tax dodges, such as large insurance policies, will lose their allure.

Instead of an internationally agreed upon corporate minimum tax corporate income tax, asset VAT rates will be coordinated so that international market shifting will not occur based on tax rates.

Note to Republican Members: President Bush 41 was not denied a second term because he went back on his no new taxes pledge. Indeed, the 1990 Tax Act began the period of growth in the 1990s, which were accelerated by President Clinton. As we come out of the COVID recession, higher taxes on the wealthy are desirable, and will occur.

Build world-class transportation infrastructure. Infrastructure should not be paid for by the rich. Such funding is not sustainable over time. Increased motor fuel taxes, with a return to projects coordinated between members of Congress and local governments, is the traditional approach until the late-Senator McCain led the charge against “pork barrel” funding. The reality was the high taxes were considered tolerable when paired with bringing home the bacon. Even Congressman Ron Paul realized, at my urging, that agreed upon spending was preferable to spending based entirely in the federal contracting and grant sectors.

Motor vehicle fuel prices are generally inelastic to about $4.00 per gallon or more. Taxes that result in fuel taxes below that point will not affect revenue. Paired with improvements in public transit, the emission of greenhouse gases, as well as more acute emissions, will be served by higher prices.

Market manipulation of oil prices in the New York Mercantile Exchange is not unheard of. Indeed, it likely had a cause in the Great Recession, as oil traders tried to tap mortgage backed securities when prices dropped due to the examination of market practices by Congress. The deregulation undertaken by Mr. Mulvaney in his service (if that is what you want to call it) at the Consumer Finance Protection Bureau undid the market reforms enacted in Dodd-Frank. Restoring these reforms must be a priority.

With the rise of electric vehicles, some form of mileage based tax is appropriate, although developing it is problematic. We must raise gas taxes first while we develop the concept.

Invest in research and development (R&D) and cutting-edge technologies to spur American innovation, competitiveness, and job creation. Strengthen American leadership in science, technology, and innovation. NASA funding can generally be regarded as an overseas deployment. It should be funded through the defense research and acquisition appropriations. This allows for a new “peace dividend” without loss of the military industrial base. Defense contractor human resources are not readily transferred to the civilian sector. One such effort is research on Closed Loop Environmental Support Systems. Doing so could provide alternate means of agriculture, water treatment and home building. It ends the problem of population, conceivably on a worldwide basis.

This change ends the need for the defense industry to encourage the purchase (and use) of the weapons of war. Given the admission that UAB’s may be extraterrestrial in nature, or a planetary technology that we do not understand, research and development in aerospace should be maintained. Firing weapons at UABs is not advisable, so a peacetime agency should be engaged in this research. One year ago, the concept of investigating extraterrestrial visits would not have found its way into anyone’s comments on national security.

Invest in the knowledge, technologies, and actions needed to tackle the climate crisis and lead in the clean energy economy. A carbon value added tax should fund improvements in technology. A VAT, rather than an embedded tax, allows consumers more information in making their consumption decisions. The possibilities for funding research have already been submitted to the Energy and Water Development Subcommittee. I suggest two initiatives:

Fusion is a game changer and should be funded on a crash basis before we have to turn out the lights to avoid treading water. Helium-3 is promising and there is even some noise about cold fusion on a larger scale. Energy companies like how cheap coal is and how much cheaper and more popular natural gas is. Utilities (and even coal producers) need to be offered a way to hedge their bets. To move fusion, set up a public-private partnership to sink in more money in exchange for the right of first use. Any practical use of fusion will be big-industry. It was never going to be any other way. Funds should be increased for fusion now, with a promise of ever greater funding once industrial partnerships are created.

One use for such cheap power is a new transportation system. We can pilot this now, in cooperation with the Departments of Commerce and Transportation, automobile manufacturers, utility companies and eventually selected local governments. I described the project in my CJS appropriation testimony.

To best utilize clean energy (even natural automated cars with central control (rather than their own AI) and energy distribution (rather than being hampered by economically damaging battery development). The latter is old technology, i.e., electric trains and buses.

The same consortia that fund the project can be the backbone for implementing it. Individuals could own cars, while some would be for hire (with monitoring, but not drivers). Debit cards or a link to checking accounts would pay for the car itself (either to rent or own), the roadway and the use of energy and computer services.

Prices would vary based on congestion and vehicles could be taken to a public transportation hub (which might be located at their children’s school), with the vehicle returning home empty or going to the next fare. If congestion is low, it may be affordable to drive to work. If it is high, prices for public transit and commuting would be adjusted accordingly. We can do this now. The technology is already available. We need only be willing.

Ensure high speed broadband reaches all Americans. Integrated electric car systems would include household data services, so adding xFinity and Cox to any development consortium is appropriate. Broadband services in remote areas and to poor households should be available to all, although they should be funded by state level property taxes and increased telecommunications fees for current subscribers.

Make transformative investments in a renewed electric grid and energy-related economic development. Energy infrastructure to power an integrated electric car system would also carry household energy that relies on an effective grid. We agree on all initiatives in the President’s Budget. These should eventually be funded by a carbon value added tax. Such a tax will be easier to pass with vigorous enforcement of environmental regulations, with punitive fines. Industry will beg for such alternatives.

In the interim, while tax reform is in negotiations and development, these projects should be funded by increased debt (which is appropriate for capital projects), with increased taxation of the wealthy, both immediately and through asset value added and higher tier subtraction VAT in the longer term.

Improve public health by rebuilding clean drinking water infrastructure. This is an essential program,which should be implemented through EPA Clean Water Grants to poor neighborhoods. This should be supplemented with state level property taxes and water bills for wealthier neighborhoods and in the long term. In general, state property taxes would be tapped for construction of a portion of the electric vehicle program listed above. Water lines will also eventually be tied to any sprinkler system as well. If roof decks are included, storm water runoff would also be included, which would help local water systems.

State, cooperative and local property taxes would also fund public safety, with the state level employer-paid subtraction VAT funding human resource expenditures.

Revitalize American manufacturing and small businesses, creating economic and job growth across the country. From our usual comments on international trade: Consumption taxes could have a big impact on workers, industry and consumers. Enacting an I-VAT is far superior to a tariff. The more government costs are loaded onto an I-VAT the better.

If the employer portion of Old Age and Survivors Insurance, as well as all of disability and hospital insurance are decoupled from income and credited equally and personal retirement accounts are not used, there is no reason not to load them onto an I-VAT. This tax is zero rated at export and fully burdens imports.

Let us look at small business more closely. The cure for franchising, which is designed to insulate large companies from inventory, property and organized labor risks, would be less attractive with enactment of an employer-paid subtraction value added tax. Large firms would want these tax benefits for themselves.

Gig work and the misuse of 1099 employment would also be reduced, which will greatly decrease the number of small businesses as currently measured. Federalizing the enforcement of existing labor law and increasing both funding and fines for violation will also allow a focus on true small businesses. Aid to small businesses can then be focused to where it is needed.

Build and retrofit buildings across the country for energy efficiency and expanded housing options. Energy efficient buildings should include roof decks planted with grass (both roads and any other flat roof. This is another initiative which is best managed at the local level, funded by property taxes supplemented by grant support.

Invests $400 billion in home or community-based care for seniors and people with disabilities. Home and community-based care should be funded by goods and services taxes as part of a newly created Medicare Part E. Senior Medicaid should be entirely federalized, with other clients insured through the President’s proposal for a public option.

President Reagan’s New Federalism proposal would have removed Medicaid from state budgets in exchange for ending or block granting other federal programs. This was a good idea then and a better idea now. Medicaid Part E should be created to both relieve states and the District of Columbia (or Washington, Douglass Commonwealth) from providing Medicaid for Seniors and the Disabled and seeing to the enforcement of practice standards for nursing homes who receive these funds.

Support workforce development; provide four additional years of free education. Make historic investments in education. Local welfare programs will channel clients to appropriate educational programs (with no legal residency requirement), training through workforce investment boards or other social services. One Stop programs should really be handled in one stop. Programs, both public, private and sectarian, should be funded by a state-level employer-paid subtraction VAT. They will include the following

- English as a Second Language

- Expanded Job Corps

- General Education Degree preparation

- Technical and vocational training

- Psychiatric and occupational rehabilitation programs

- Community College and the first two years of four year programs to an Associate's Degree or through sophomore year

All of the above should include a stipend at the minimum wage pending satisfactory performance and be tuition free). Education providers will be the conduit to tax benefits and any other state or federal subsidies.

Medicaid for poor families should be distributed, where possible, through the health insurance plan of their educational providers or the plan for state and local government employees. SNAP payments should be abolished, as well as TANF, except for people who cannot be enrolled in another program. For these, SNAP must include a cash benefit, thus ending the incentive to sell food stamps in order to buy toilet paper or gasoline.

Make critical investments in child care. Childcare is best provided by the employer or the employee-owned or cooperative firm.On-site care, with separate spaces for well and sick children, as well as an on-site medical site for sick employees, will uncomplicate the morning and evening routine. Making yet another stop in an already busy schedule adds to the stress of the day. Knowing that, if problems arise, parents can be right there, will help workers focus on work.

Larger firms and government agencies can more easily provide such facilities. Indeed, in the Reeves Center of the District Government, such a site already exists. When the crisis is over, a staff visit would prove illuminating. Smaller firms could make arrangements with the landlord of the building where offices or stores are located, including retail districts and shopping malls. For security reasons, these would only serve local workers, but not retail customers.

These programs should be paid for with increased employer-paid subtraction value added taxes, with credits for companies that provide these benefits and higher taxes for those who do not. A tax on employers would help society share the pain for requiring paid leave. Firms that offer leave would receive a credit on their taxes (especially low wage firms.

Create universal paid family and medical leave. Not requiring sick leave has been justified by the reactionary sector that claims that in the end, the market will sort everything out. The perception that doing the right thing makes a business non-competitive is the reason we enact minimum wage laws and should require mandatory leave. Because the labor product is almost always well above wages paid, few jobs are lost when this occurs. Higher wages simply reduce what is called the labor surplus, and not only by Marx. Any CFO who cannot calculate the current productive surplus will soon be seeking a job with adequate wages and sick leave.

The requirement that this be provided ends the calculation of whether doing so makes a firm non-competitive because all competitors must provide the same benefit. This applies to businesses of all sizes. If a firm is so precarious that it cannot survive this change, it is probably not viable without it.

Extend key tax benefits for lower- and middle-income workers and families. The child tax credit level passed in the American Recovery Act should be made permanent and doubled, with distribution through private sector payrolls, unemployment insurance benefits, emergency benefits for families and paid participation in educational programs.

There are two avenues to distribute money to families. The first is to add CTC benefits to unemployment, retirement, educational (TANF and college) and disability benefits. The CTC should be high enough to replace survivor’s benefits for children.

The second is to distribute them with pay through employers. This can be done with long term tax reform, but in the interim can be accomplished by having employers start increasing wages immediately to distribute the credit to workers and their families, allowing them to subtract these payments from their quarterly corporate or income tax bills.

Deliver nutrition security to America’s vulnerable families. Increase the supply, quality, and affordability of rental housing. The best option for food security and low income housing is to increase incomes by increasing the minimum wage, increasing the child tax credit and monthly payments for old age, survivors and disability recipients. For the latter, rebasing past wages to wage increases will help, but shifting the employer contribution and disability insurance to funding with a border adjustable goods and services tax, crediting past and future contributions on an equal dollar basis (rather than as a match for the employee contribution. VAT funding means a larger tax base and easier rate increases.

Increasing the minimum wage to $10 wage should take effect immediately, phasing to $12. You can argue about a $15 or $18 minimum after the midterm elections. Higher minimum wages increase job growth, as lower wage employees spend every dime of the increase, as do higher wage workers below the middle-management level whose wages will also rise. Provisions should also be included in law to hold franchisers harmless if minimum wage increases impact their own livelihoods.

Strengthen public health infrastructure to enhance our ability to address existing and emerging threats. Let me add that federal medicine should not be siloed. Doctors in the Uniformed Public Health Service, the Military, Veterans Affairs, and those implementing a Medicare Part E should frequently communicate and be used to sharing information. They should also take over medical services for the border patrol. It goes without saying that funding must increase, as proposed (which I said anyway).

We need to also pay attention to mistakes and organizational pathologies that made the COVID pandemic worse, such as treating the PPE needs like we were treating Ebola and missing critical cold symptoms that occurred to most as seasonal allergies, went a way for a week and when they recurred as serious disease were thought by patients to go away as they did the first time. Missing this was a fatal mistake. Talking about believing in science also tripped the alarms of many conservatives who do not trust such statements, which made the pandemic worse.

Support needed reforms in the justice system. Job one is to shift from correctional modalities to new methods featuring mental health, education (including ESL programs) and addiction medicine. Warehousing young males of any race, but particularly African-Americans multiplies societal pathologies. While some forms of illness, such as sexual violence and physical violence or murder may require higher security, others can be treated as patients rather than criminals.

This change would migrate to local law enforcement, i.e., policing. Respond to certain incidents (especially those involving mental illness or alcohol) with immediate dispatch of emergency medical teams. This would require more ambulances, more mental health facilities and a pause in applying restraints until medical personnel arrive.

Fulfill the sacred obligation to our veterans. In recent decades, the problem of veteran disability determinations has remained troubling, with the Pandemic complicating processing. When a job gets too big to manage with staff, two options remain - contract out as much work as possible, including consolidating case files and making easy determinations - and sharing responsibility for processing with the Department of Defense. The handoff from DoD to DVA should be seamless.

The mental health and housing needs of veterans, both recent and lingering, is endemic. This is another area where coordination with DoD would prove helpful. This help must go beyond management and computer systems and include the human element of soldiers, veterans using services and those who need services can interact on a less formal, but not unprogrammed basis.

Make global leadership a priority. We must add rebuilding the Diplomatic Corps, which was savaged by the prior Administration. Every effort should be made to investigate what really happened with the “perfect phone call.” It may have been the perfect cover-up for a Kremlin led plan to cut military aid to Ukraine, with Mr. Giuliani and Secretary Pompeo acting as the President’s handlers rather than his agents. Provisions should be made to investigate where presidential discretion ends and foreign agency begins.

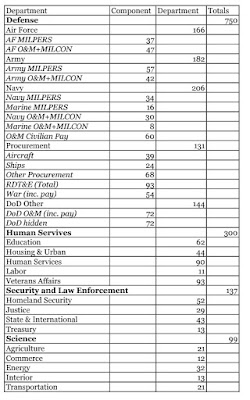

Meeting National Defense Needs. In general, we recommend that non-strategic air and ground units based in CONUS be funded from the goods and services tax, while sea, overseas (OCO) operations and veterans benefits be funded with asset VAT and higher tier employer-paid subtraction VAT revenues, which will also fund net interest and paying down the Social Security and Medicare Trust Funds.

Essentially, federal defense spending which benefits the homeland will be paid by American taxpayers, but not by exports. The current regime can be seen as an unconstitutional export tax. Department of Defense product and logistic commands will be funded based on where units are assigned and based. Strategic systems will be nationally funded.

Overseas deployments and war are generally put on the national credit card. It is generally better to tax higher income individuals rather than paying them interest instead. The cash flows are the same, but taxation means that the cash need not be paid back at interest.

Attachment: Tax Reform

Attachment: Debt as Class Warfare